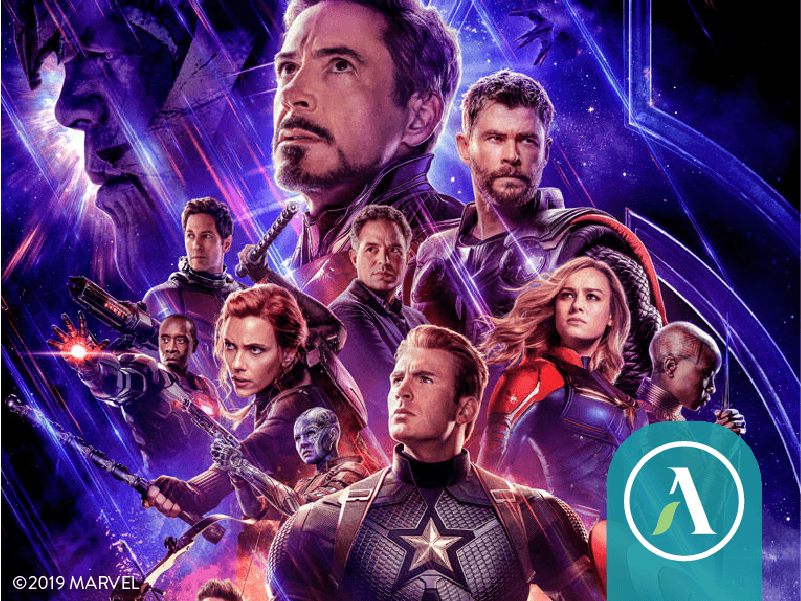

What’s Your Endgame?

*Warning: possible Avengers Endgame spoilers*

From the upcoming conclusion to the Skywalker saga to the record-breaking Avengers series, pop-culture is awash in discussions about legacy. Fans who have followed characters they love for years are deeply invested in what the franchise finales will leave behind. But legacy is not restricted to heroes in a fantasy realm – we can establish our own endgame right now.

Protect Your Legacy

Although we need not fear Thanos’ famed snap that turned the Avengers to dust, it is a fact that more than half of all deaths are sudden or unexpected. Even when we do have time to think things through, many people don’t make plans or discuss their wishes with family and friends. This lack of planning can cause profound heartache for those left behind. There are far too many stories of care decisions delayed by confusion over who’s in charge and siblings who aren’t talking to one another anymore because of how their loved one’s possessions were divided. That’s certainly not the legacy most of us want.

Legacy Planning Starts with a Simple Conversation

“It’s hard sometimes,” admits Abundance Canada client John Zilke*, “but it’s the least we can do for those we love.” John learned firsthand how important it is to talk about death and dying before a crisis happens. John’s mother experienced a sudden serious health scare in her early sixties, and amidst the chaos John and his siblings realized the scary truth that none of them knew what their mother wanted.

Thankfully, she recovered, but from that time forward the family made a point of discussing aging, dying and death. John remembers, “Mom wove it into everyday conversations. She was careful not to overwhelm us, but she was quite clear about what she did and did not want.” As she got older, she started inviting John and his siblings to join her at lawyer, accountant, and doctors’ appointments. “Even in my sixties, Mom was still able and willing to teach me about aging well, dying and death”.

Continuing the Legacy of Open Communication

John’s mother passed away shortly after her 90th birthday, and thanks to her gentle guidance and frank communication over the years, her family knew exactly what she wanted and what was important to her. “It made a difficult time much easier for us,” says John. The peace of knowing that everything from funeral arrangements to charitable donations were part of their mother’s chosen legacy was like her final generous gift to the family. John says, “I’ve continued the tradition and have begun to have conversations with my own spouse and children”.

So how do we get these conversations started? What questions should we be asking to help build our own generous legacy?

Wills: The Legal Side of Legacy

When it comes to legacy planning, the first question is whether you have a will. If not, it’s time to get one, and if so, it’s important to make sure it still reflects your current wishes. It’s also important to tell your family where to find the original copy of your will.

You might also want to consider whether your family members are capable and willing to handle your estate, or if you should hire a professional estate trustee service. No matter who is managing your estate, it can be very helpful to keep an up-to-date summary of what you own and what you owe. If you plan to give a portion of your estate to charity, sharing your passion for the organizations you plan to support can help your family feel more comfortable with the gift and may spark further interest in the causes you care about.

Incapacity Documents: More of the Legal Side of Legacy

Although it’s not something we often think about when we’re feeling good, it’s important to consider that we may not always be healthy enough to make important decisions about our healthcare or the things we own. Incapacity documents guide our loved ones in making decisions on our behalf. Have you prepared legal documents permitting someone to act on your behalf if needed? And have you notified the people you’ve named?

Even with official paperwork in place, it’s important to talk openly about your preferences before a crisis strikes. Introduce the person chosen to act on your behalf to your doctor, financial planner, accountant, and lawyer during routine appointments or annual reviews. Knowing your wishes can be a real gift to your loved ones.

Talk About Your Legacy Today

Like the memorable quote from Ironman Tony Stark, we know you love your family “3000” [1]. And we know the topics of illness, ageing, and death aren’t easy to tackle. Abundance Canada has several free, downloadable resources available that can help. Set the example for your family and start the conversation today. It’s a discussion you won’t regret.

Contributed by Marlow Gingerich

Gift Planning Consultant

*Pseudonym used to protect the privacy of the individual

[1] For non-movie buffs, this can be translated to “a lot”.