Discover the Tremendous Benefit of Donating Publicly Traded Securities to Charity

Donating publicly traded securities (stocks, bonds and mutual funds) is the most tax-efficient way to make charitable donations. When publicly traded securities are donated “in-kind” to a Canadian charity like Abundance Canada, the capital gains inclusion rate drops from 50% to 0%.

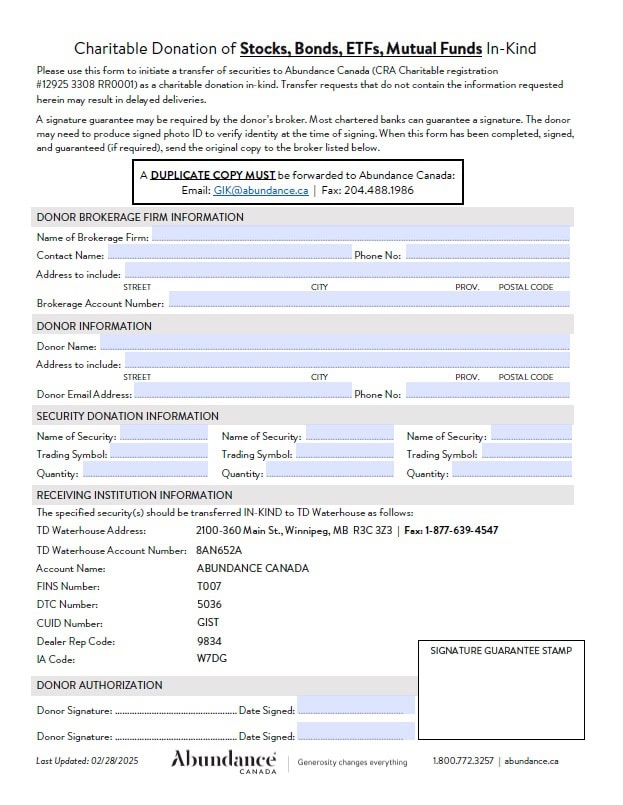

Instead of selling the securities, your client transfers them to Abundance Canada as a gift in-kind.

Abundance Canada will send your client a donation receipt for the fair market value of the securities on the day they initiated the gift-in-kind transfer.

Example of the Tax Advantage for a Donation of Securities to Charity

| Sell securities and donate cash | Donate securities as gift in-kind | |

|---|---|---|

| Donation to charity | $50,000 | $50,000 |

| Adjusted Cost Base | ($10,000) | ($10,000) |

| Capital Gain | $40,000 | $40,000 |

| Taxable Capital Gain | $20,000 (50%) | $0 (0%) |

| Marginal Tax Rate (example) | 40% | 40% |

| Tax Payable | $8,000 | $0 |

In this example, when the securities are donated directly to the charity as a gift in-kind, your client does not realize a taxable capital gain, saving them $8,000 in tax payable. The $50,000 donation receipt can then be used to off-set other income tax payable.

Tax Planning Tips:

- Eliminate the taxable capital gain on the donated securities

- Client receives a donation receipt based on the fair market value of the securities on the date they initiated the transfer to Abundance Canada

- Client uses donation receipt to off-set other income tax payable

Download a copy of our Technical Information Sheet on Publicly Traded Securities here.

Next Steps

Contact Abundance Canada if you have clients who might benefit from donations of publicly traded securities.